Home ownership.

Let’s do this thing.

Whether it’s your first or 70th time buying property, let us help you get the mortgage you want and need. We work hard to find you the best rate across multiple lenders, so you can pocket the difference.

Book a Call

Book a Call

-

Schedule a Consultation

Let’s hop on a call so that we can find our what your goals are. From there, we’ll put together a list of options for you to review.

-

Submit Your Documents

Once we’re aligned, we’ll start by collecting all of your documents so that we can get you pre-approved to shop for your house.

-

House Shopping Time

You’re pre-approved, now it’s time to look for your dream home. Feel free to start making offers and please keep us in the loop!

-

Finalize Your Mortgage

Your offer’s been accepted! Now it’s time to get all the final things out of the way for closing. You’re going to be a home owner!

-

I’m thinking of buying...

We like your speed. There’s no rush when in comes to buying your first home. But in the meantime, see what you can afford using our mortgage calculator.

-

I’m ready to buy!

So you’ve got the house picked out and the whole thing mentally redecorated, now it’s time to see if you can buy it. Find out in minutes if it’s in your budget!

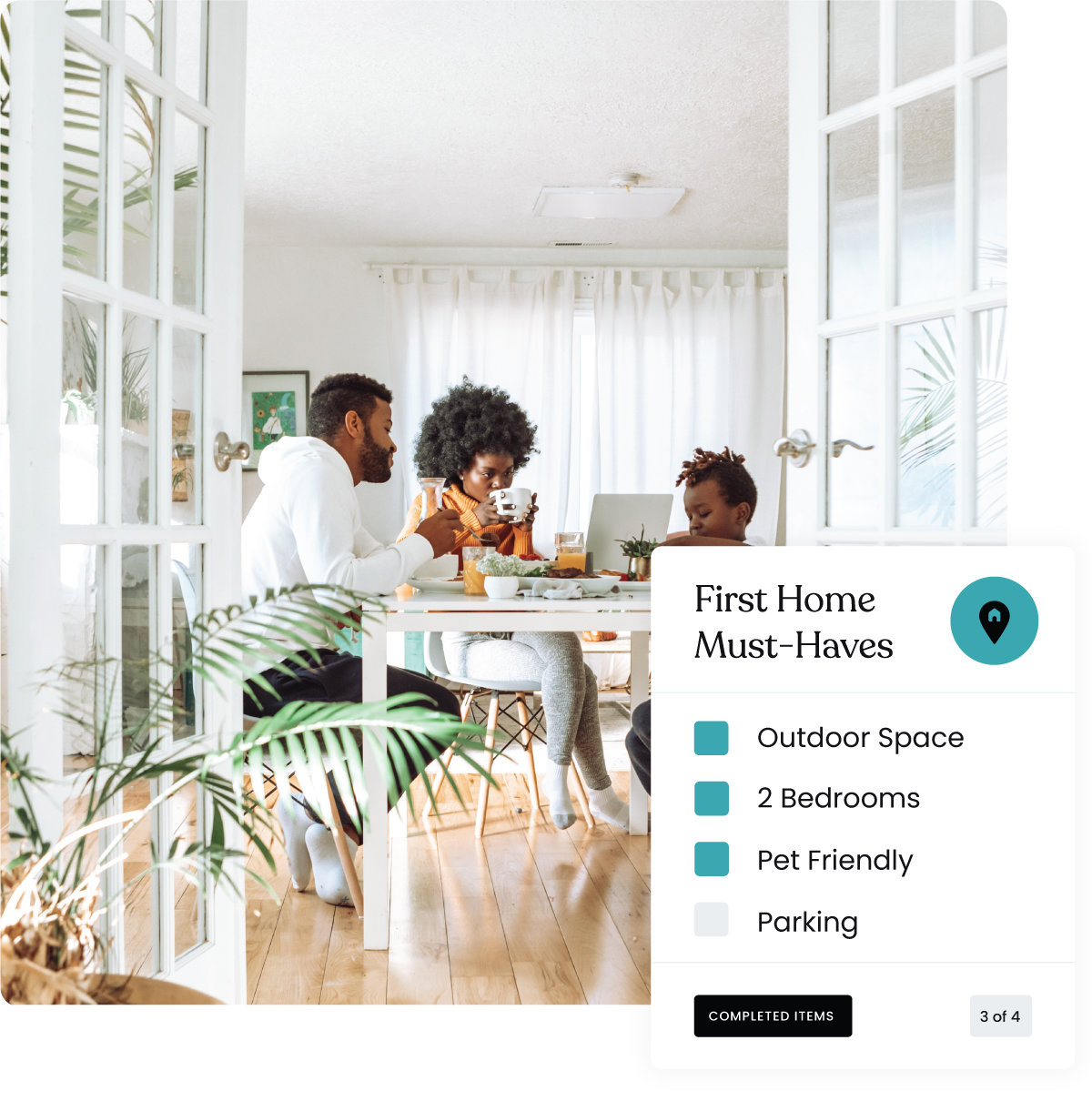

First-Time Home Buyers

Buying your first home doesn’t have to suck.

Your first house purchase can be scary. Let us help you take advantage of all the first time buyer perks, whilst guiding you through the whole process. We’re your mortgage partner.

Buyer FAQs

-

A down payment is the amount of money you put towards the purchase of a home. The minimum amount you need for your down payment is 5% of the purchase price.

-

As a general rule, no more than 30% to 32% of your gross annual income should go to mortgage expenses, such as principal, interest, property taxes, heating costs and strata fees.

-

Get your questions answered to see if we are a good fit for your needs.

Submit you mortgage application and documents.

Decide on your mortgage lender and product and shop of a house.

Purchase your home and complete the mortgage